In the world of commercial real estate, distress represents a critical turning point where financial strain begins to overwhelm a property’s financing structure. Distressed properties are those caught in a difficult position—unable to meet their debt obligations, falling behind on payments, or stuck in limbo as their loans mature without refinancing options. As interest rates rise and economic conditions tighten, the frequency of distress increases, opening up both challenges and opportunities. For investors, distressed assets can signal the potential for high-reward acquisitions, but they also carry significant risks tied to fluctuating market conditions and unpredictable borrower behavior. Understanding the dynamics of distress in real estate financing is key to navigating these complex waters.

Where is the distress?

There is approximately $4.7 trillion in outstanding commercial real estate loans, with $2.1 trillion secured by multifamily properties.

The majority of this multifamily debt is held by Government Sponsored Entities Freddie Mac and Fannie Mae (48%), Banks (31%), and Life Insurance Companies (12%). The remaining portion is held by state and local governments (6%), CMBS, CLO, and other ABS issues (3%).

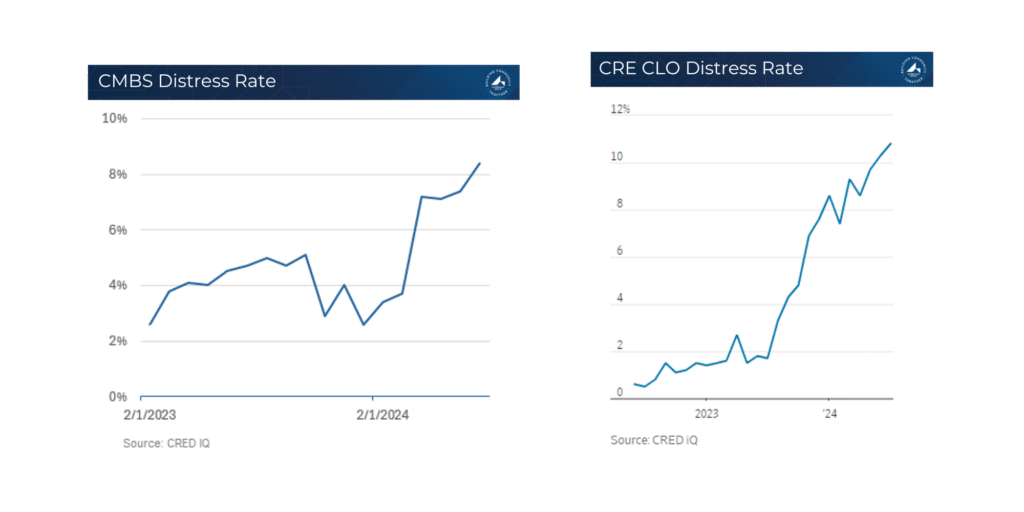

Let’s focus on the 3% held by CMBS (Commercial Mortgage-Backed Securities), CLO (Collateralized Debt Obligations), and other ABS (Asset Backed Securities). The issuance of this type of debt reached its peak in 2021 and 2022, which coincided with the peak of the multifamily value cycle. Typically, these loans are short-term in nature with adjustable rates linked to SOFR (Secured Overnight Financing Rate). SOFR has increased by 500 basis points from 2021 to 2023, putting considerable strain on borrowers who opted for this type of financing. Over the last 6 months, CLO distress rates have increased to 13.3% in July 2024 from 8.6% in January 2024 (CredIQ). Additionally, CMBS loans backed by multifamily properties have seen a rise in distress to 8.4% in July 2024, up from just 2.6% in January 2024. Distress is defined as any loan that is 30 days delinquent, past its maturity, or in special servicing where a third party works to find the best outcome for the troubled loan. Although these loans make up only a small portion of the total outstanding multifamily debt, there could be significant opportunities in the future when these loans mature and property owners need to offload overleveraged properties.