Where are multifamily values headed, and what drives these fluctuations? In the real estate landscape, understanding the core dynamics behind property valuations is essential. The multifamily sector, in particular, hinges on two main elements: liquidity and net operating income (NOI). As market conditions shift, from the highs of the 2010s to the pandemic-induced turbulence and beyond, the balance between these factors continuously reshapes the value of multifamily assets. Today, as we navigate an environment marked by rising interest rates and increased vacancy, the question remains—where do we stand, and where are we headed next?

Multifamily values are driven by two key factors:

– Liquidity – Access to Debt and Equity

– Net Operating Income

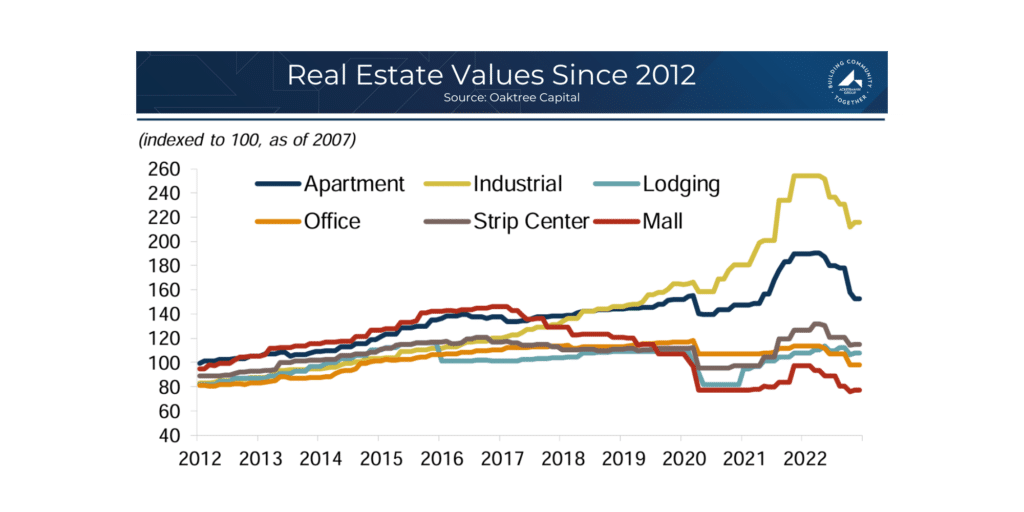

Throughout the 2010’s multifamily values slowly but steadily increased as Net Operating Income (NOI) grew and Capitalization Rates compressed (relationship between NOI and Value or NOI/Cap Rate = Value). Liquidity in the market was plentiful with the federal funds rate near zero and equity investors with few options to capture yield.

This changed when the pandemic lockdowns began in March 2020. Uncertainty around employment and therefore collections caused a dip in values during 2020. However, as the dust settled it became apparent that mass layoffs were unlikely and employment was still near record lows – values rebounded and then exceeded past highs. Interest rates bottomed out and reached record lows while rent growth and occupancy reached record highs, creating NOI growth and excellent liquidity in the market as both debt and equity investors rushed into the space. The blue line in the below chart shows apartment values compared with all other asset types.

Since the rate hiking cycles began in mid-2022, valuations have fallen while the operating environment has become more challenging. Record high inventory growth has led to slow, and in some markets, negative rent growth along with increases in vacancy nationwide.

As a result, NOI growth has been subdued and liquidity has decreased causing valuations nearly to return to levels seen pre-pandemic.

Is this the bottom?

There is no way to definitively say, but some of the largest players in the industry are making big bets – Blackstone purchased Apartment Income REIT for $10B, Brookfield bought a 7,300 unit portfolio from Starwood for $1.55B, and KKR acquired 18 properties from Quarterra for $2.1B.

Forecasts for the 4th quarter are expecting slow rent growth and slightly better occupancy. If the Fed decides to cut interest rates, values could rebound and begin to increase again.