The Trend

Investors said they were targeting multifamily more than any other property type. With thirty-seven percent of all U.S. investors claiming that multifamily was their number 1 target. As the real estate market continues to evolve, multifamily properties remain a strong contender for those seeking reliable returns on their investments. The increasing interest in multifamily properties among investors is driven by their potential for stable cash flow, reduced risk, long-term appreciation, and the ability to tap into various tax benefits.

Why Multifamily?

Our Chief Investment Officer, Chris Kohnen, says stable cash flow, reduced risk, and long-term appreciation are the driving factors behind Ackermann Group’s strategic commitment to specialize exclusively in the multifamily real estate market.

A Look to the Future

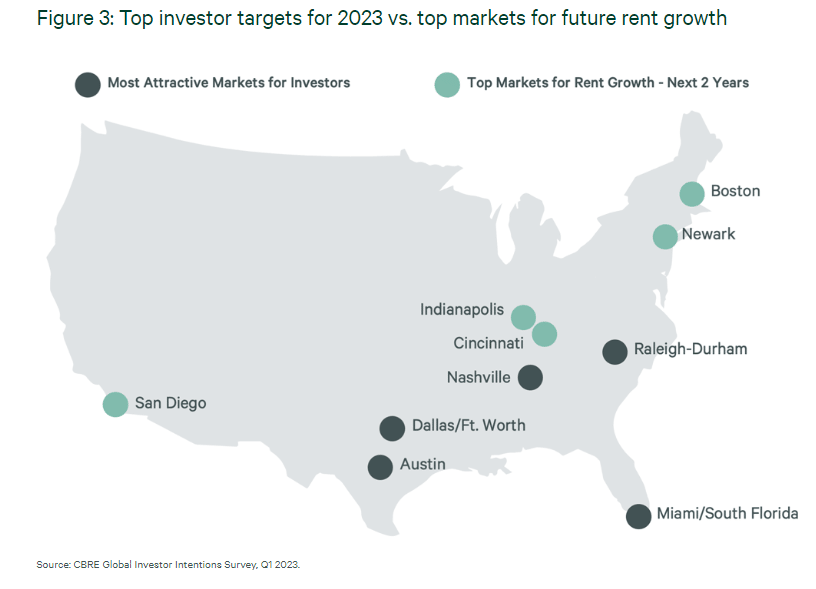

Multifamily investment is hot, and with multifamily real estate investment comprising the majority of our business, we are an expert in the industry. CBRE says Cincinnati and Indianapolis—two of Ackermann Group’s major markets—are expected to be in the top markets for rent growth in the next two years.

Read more about Investor intentions within the multifamily market here: https://www.cbre.com/insights/briefs/midyear-pulse-check-us-multifamily-market