The Economy

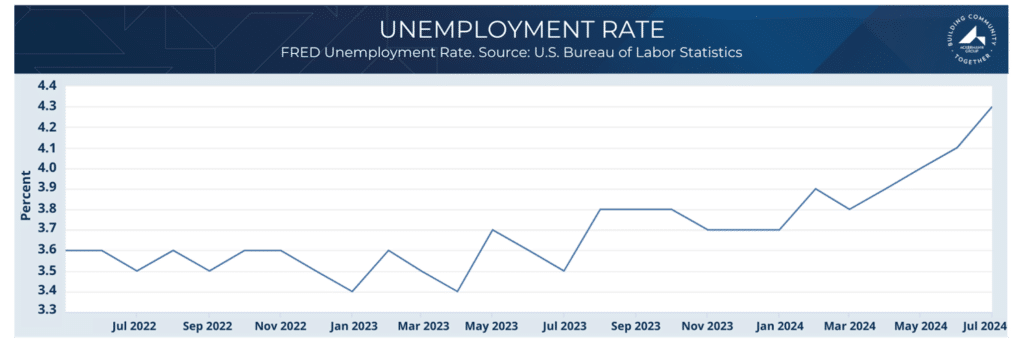

The U.S. economy continues to perform well, with Q2 2024 Real GDP growth reaching an annualized rate of 2.8%, doubling from 1.4% in Q1 2024. This growth is accompanied by modest shifts in the labor market and easing inflation. The labor market shows signs of softening with the unemployment rate rising to 4.3% in July 2024, up from a low of 3.4% in April 2023. The unemployment rate remained below 4.0% for two and a half years, marking the longest such period since the 1960s.

Inflation continues to ease, with Core PCE1 growing at 2.9% in the period, down 80 bps from Q1 2024. Looking ahead, the second half of the year is expected to bring moderate GDP growth, stable unemployment, and slightly lower inflation.

Interest Rates

The Federal Reserve has kept the federal funds rate steady since August 2023, with a target range of 5.25-5.50%, the highest level since 2001. As inflation gradually eases and the labor market cools, many economists anticipate that a rate-cutting cycle could begin in September. However, the path of interest rates and broader monetary policy remains closely tied to the economy’s overall performance. If inflation remains above target, the Federal Reserve may choose to keep interest rates elevated for an extended period, which could deter developers and put additional pressure on over-leveraged property owners with floating-rate debt. On the other hand, a significant economic downturn could lead the Fed to implement earlier and more substantial rate cuts, potentially revitalizing asset values.

National Apartment Market

Following a volatile 2023, the first half of 2024 has brought increased stability to the market. Despite a surge in supply growth, national rent growth rebounded to 1.1% in Q2 2024, an improvement of 100 bps from Q1. Moreover, national occupancy rates increased for the first time since Q1 2022, albeit 10 bps both provide signs of a positive turn from the negative rent growth and declining occupancy experienced over the last 15 months.

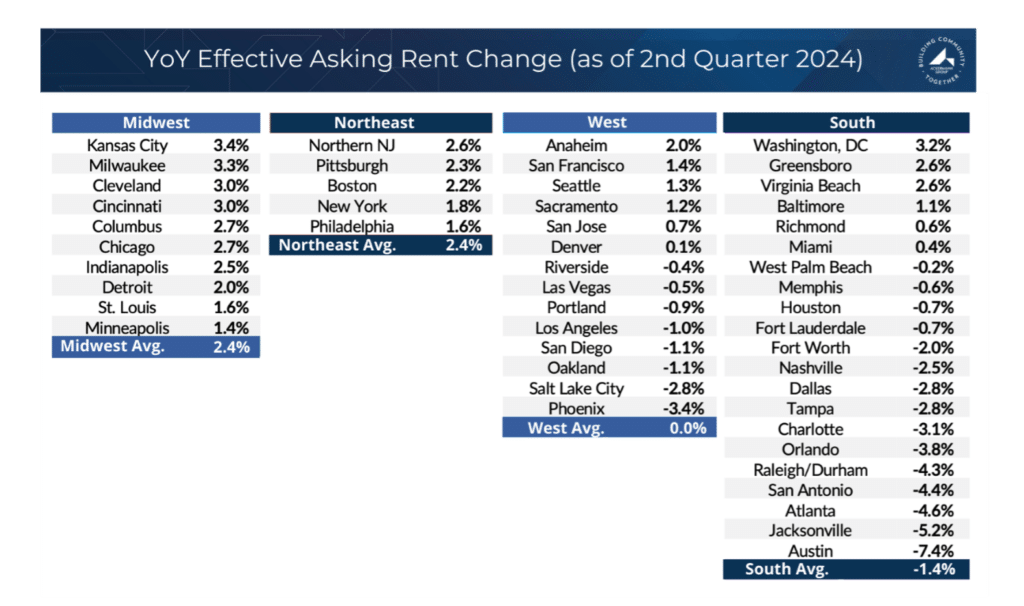

However, these positive shifts in key operating fundamentals are not uniform across all markets and regions. The data below illustrates the year-over-year changes in asking rents across the 50 largest markets in the country, with a regional summary of growth or decline. Like Q1 2024, Southeast and Western markets that have experienced strong in-migration and supply growth are seeing rent decreases, while supply-constrained markets in the Midwest and Northeast are outperforming in terms of both rent growth and occupancy.

National Apartment Market (continued)

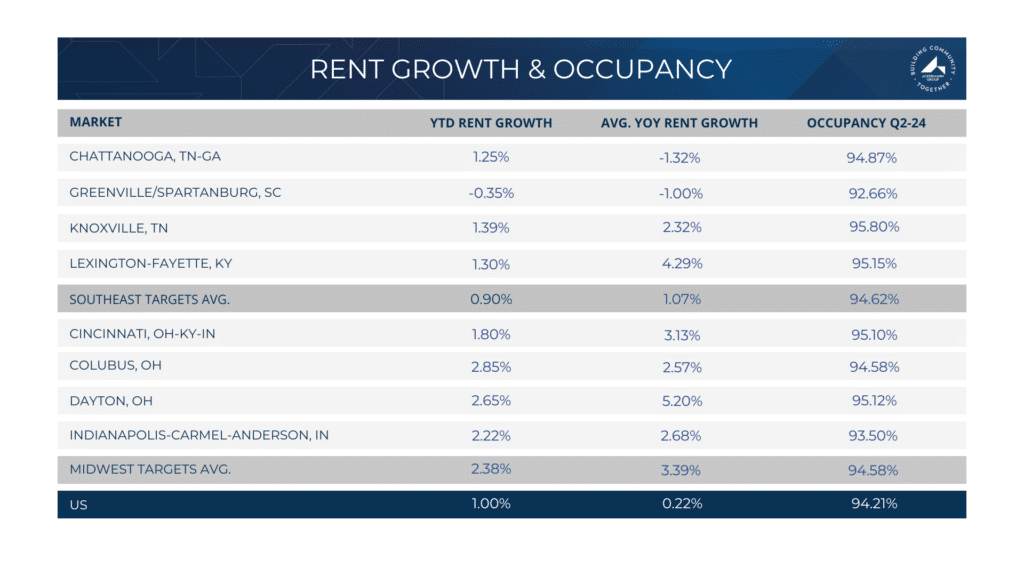

Likewise, Ackermann Group’s target markets in the Midwest continue to demonstrate stability compared to national trends, while the Southeast target markets are showing resilience despite increased supply.

Supply

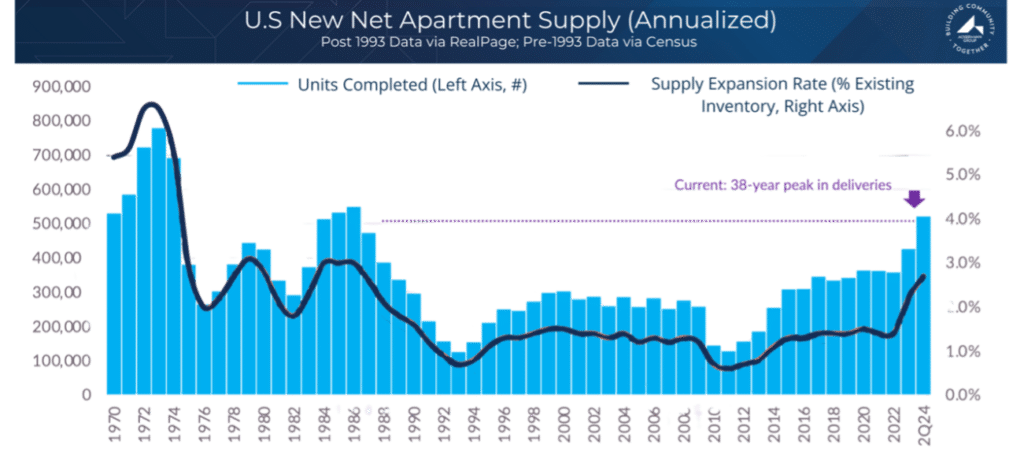

The construction boom has been a defining trend over the past year and is expected to remain a significant factor in the national multifamily market through at least 2025. In 2023, 446,000 units were delivered, with an additional 550,000 units projected for 2024, accounting for 2.4% of the existing national apartment inventory. The graph below illustrates the annual number of units completed since 1970. The surge in 2024 will mark a near 40-year high in apartment supply, contributing to a slowdown in rent growth and occupancy nationwide (NMHC).

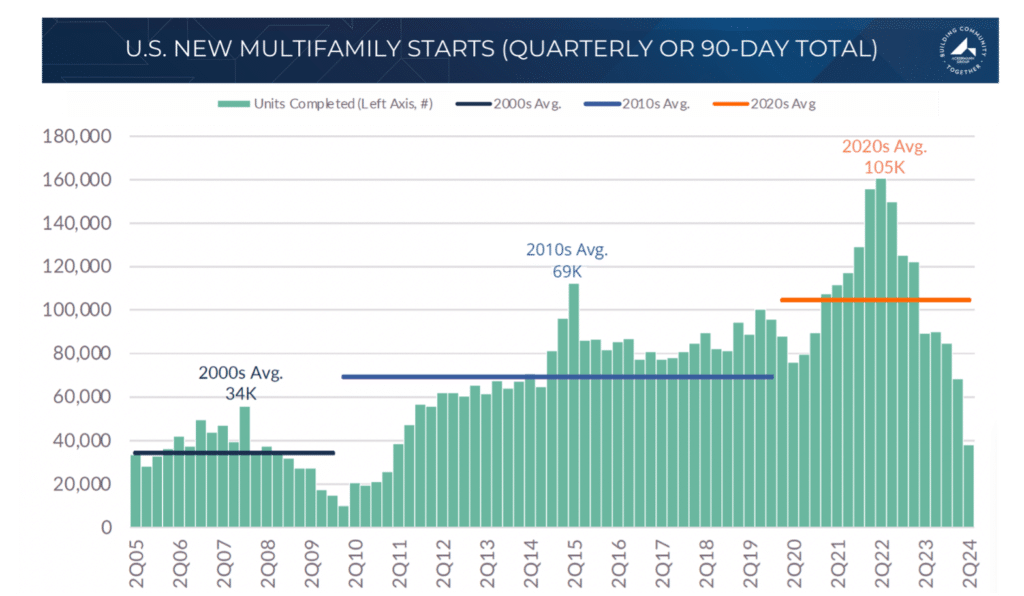

In contrast, the graph above shows multifamily starts since 2005. Construction starts began to decline when the Federal Reserve initiated its current rate-hiking cycle in mid-2022, and they have now returned to levels more in line with the early 2000s average. Since it typically takes 1.5 to 2 years to complete an apartment community, new supply is expected to decrease significantly in 2025 and 2026. This reduction, coupled with strong demand in the coming years, is likely to drive a rebound in both rent growth and occupancy.

Demand

Demand for multifamily housing is exceptionally strong by historical standards. Absorption of new units in the first half of the year is 50% higher than the historical average, nearly offsetting the surge in supply that the industry has seen over the past 18 months.

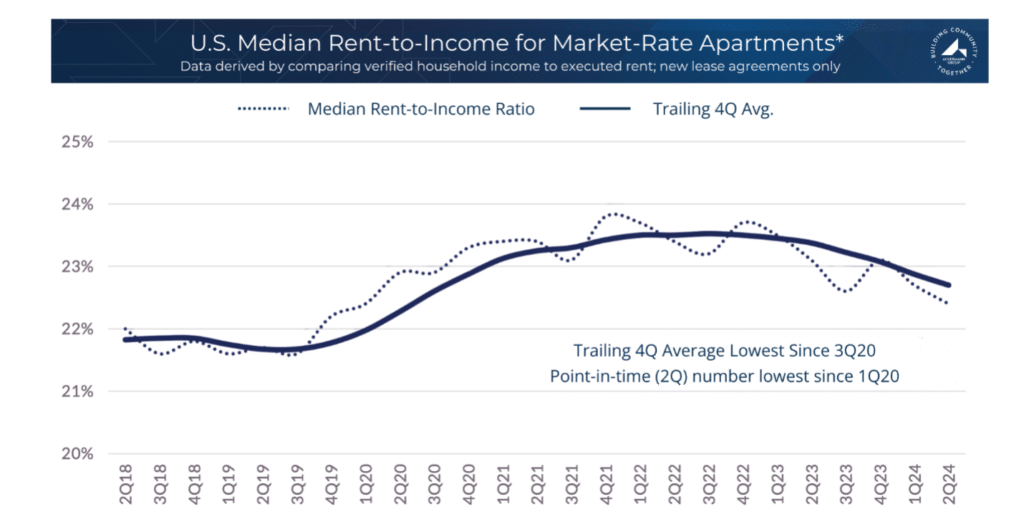

Several factors are driving this robust demand. Household incomes for renters have increased by over 2%, while hourly earnings have risen by 4.3%, and median wage growth is up 5.5% year-over-year. These wage increases, combined with flat or even declining rents in some areas, are bringing the national rent-to-income ratio back to more normalized levels last seen before the pandemic.

The average number of residents per new lease is decreasing, indicating a healthy job market as more individuals choose to live alone or with fewer roommates, thereby increasing demand for rental units.

Moreover, fewer residents are moving out to purchase homes. The following statistics from four residential REITs highlight record-low move-out rates for home purchases in Q2 2024:

- AvalonBay Communities (AVB) reported a move-out rate for home purchases of around 7%, down from a long-term average of approximately 17%.

- Essex Property Trust (ESS) saw a decline from a historical average of 12% to just 5%.

- Equity Residential (EQR) noted a reduction in move-out rates to 7.8%.

- Mid-America Apartment Communities (MAA) observed that move-outs due to single-family home purchases were at 12.9%, with overall retention at an all-time high.

Lower rent to income ratios, less tenants per unit and the high cost of single-family homes are driving demand to historically high levels.

Capital Markets

Commercial real estate lending is estimated to have reached $429 billion in 2023, marking a 47% decline from $816 billion in 2022 and a 52% drop from the record $891 billion in 2021.

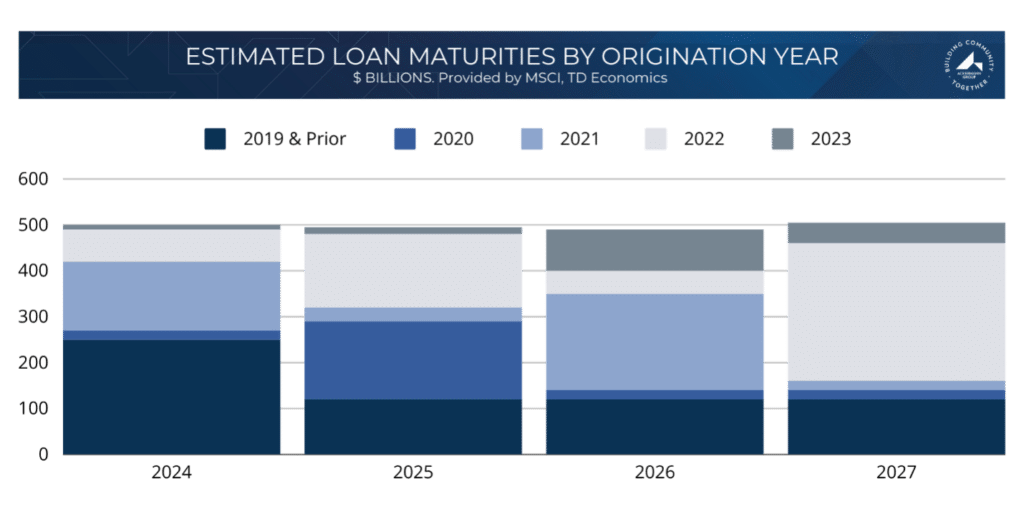

According to the Mortgage Bankers Association, nearly $2 trillion of the $4.7 trillion in commercial real estate loans nationwide will mature over the next three years. Notably, almost half of this maturing debt is secured by multifamily properties.

As shown in the graph below, 2024 marks the beginning of significant debt maturities originating from the peak period of 2021. These loans are coming due in a higher interest rate, slower growth environment, which will challenge borrowers’ ability to refinance. We anticipate that this pressure will lead to an increase in property sales over the next 12-18 months.

This three-year ‘Wall of Maturities’ is steadily growing, with many lenders granting extensions to borrowers in anticipation of lower interest rates in 2025. With the Federal Reserve signaling that it has likely concluded its rate hikes for this cycle, and with rate cuts expected later this year, a decrease in long-term interest rates could provide some relief. However, any operational weaknesses could lead to increased distress once lenders are no longer able to extend maturing loans.

Signs of distress are already becoming more prevalent, particularly among property owners who took on high-leverage, floating-rate debt during the post-pandemic peak in 2021 and the first half of 2022. In the first half of 2024 alone, distress in Commercial Real Estate Collateralized Loan Obligations (CRE CLOs) has risen to 13.3%, according to CredIQ. Similarly, distress in Commercial Mortgage-Backed Securities (CMBS) loans backed by multifamily properties increased to 8.4% in July 2024, up from just 2.6% in January 2024. These loans represent 6.4% or $67 billion, a relatively small portion of the total multifamily debt outstanding.

Ackermann Group Forecast

- The U.S. economy continues to demonstrate robust growth, though mixed signals in the labor market and inflation trends persist. The Federal Reserve’s current stance on interest rates remains crucial, with potential adjustments dependent on future economic developments.

- Political developments, including the proposed nationwide rent control and ongoing debates over tax cut extensions, could introduce uncertainty and potential challenges for the multifamily sector.

- The national apartment market is showing signs of stabilization after a turbulent 2023, though regional variability persists. In the second half of 2024, the Midwest and Northeast are expected to continue outperforming the Southeast and West.

- High levels of new supply have tempered rent growth and impacted occupancy rates, but a projected decline in new construction is likely to drive a rebound in the long term. In the short term, the second half of 2024 rent growth is forecasted to be 1.2% year-over-year with occupancy increasing slightly to 94.4%.

- Demand for multifamily housing remains strong and is expected to continue this trend throughout the second half of the year.

- Capital markets are facing challenges due to a substantial volume of maturing debt and increasing distress among high-leverage loans, presenting both risks and potential opportunities in the near term.

Despite these challenges, the long-term prospects for multifamily investment remain strong, with the current market dislocation offering attractive entry points for well-capitalized buyers.