The Economy

The US economy entered 2024 on strong footing but will slow over the next few quarters due to rising consumer debt, elevated interest rates, and moderating consumer spending. GDP growth will slow to around 1% in Q2 and Q3 2024, before gradually normalizing toward 2% in 2025. Consumer spending is expected to decelerate as households have spent much of their pandemic savings, incurred more debt at higher rates, and income growth is slowing. However, a resilient job market and an eventual interest rate cut will provide some relief. Moreover, persistent inflation driven by labor shortages and deglobalization could delay the widely expected start of rate cuts by major central banks, impacting the US economy.

Job growth is anticipated to be positive in 2024, however, the pace is expected to be modest, resulting in a slight uptick in new job additions. The influx of new supply will intensify competition, particularly among existing Class A properties. Forecasts suggest that growth at the top end of the market will be more subdued, with stronger growth expected in the middle-market workforce housing segment, reflecting a shift in demand dynamics.

Additionally, the 2024 presidential election will significantly impact the trajectory of the US economy in the coming years.

- A Biden victory would likely lead to repealing the Trump-era Tax Cuts and Jobs Act (TCJA) tax cuts for high-income earners and corporations. Biden has proposed restoring the top marginal tax rate to 39.6% and imposing new taxes on billionaires and those earning over $1 million annually.

- A Trump victory, especially with Republican control of Congress, would increase the chances of extending the TCJA’s tax provisions for businesses and top earners beyond their scheduled expiration in 2025.

Overall, the divergent economic visions of the two candidates, particularly on taxes, student loans, and economic stewardship, will influence post-election policies impacting employment growth, inflation, debt levels, and cost of housing.

Q1 2024 Market Update

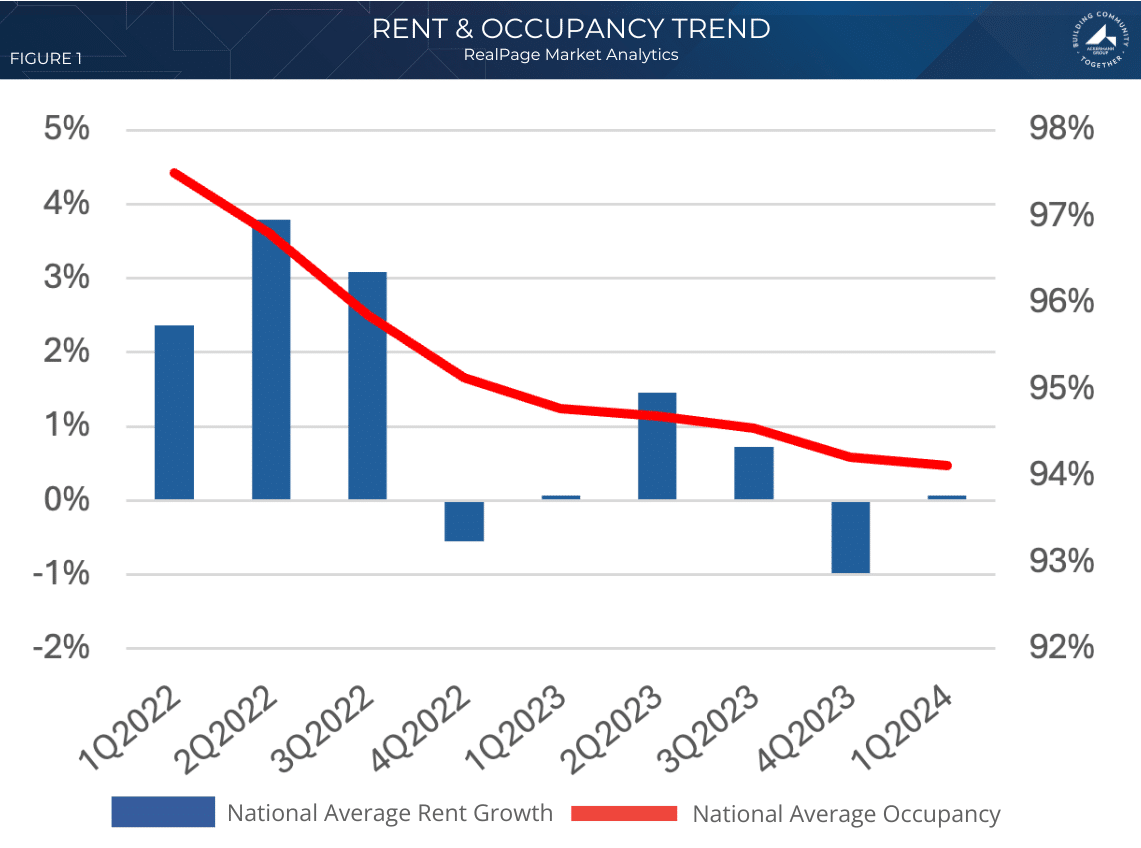

The multifamily rental market experienced a tumultuous year in 2023, characterized by fluctuating rents and occupancy rates across various regions. National apartment occupancy dropped 80 basis points (bps) year-over-year (YOY) in 2023 to 94.1% and average asking rents saw modest growth of 1.6%, with the bulk of this increase occurring in the first half of the year. Certain regions, particularly pandemic boomtowns in the Western and Southwestern states, faced significant challenges, witnessing declines in rent as high as -2.5% in Las Vegas, Nevada. On the contrary, secondary markets in the Midwest and South emerged as top performers, with impressive rent he first quarter of 2024 saw a notable increase in net absorption, driven by strong demand. This marked the third strongest Q1 performance in over 20 years, surpassing the pre-pandemic first-quarter average, according to a recent CBRE report. Average occupancy across the country averaged 94.1% in Q1 2024, down 11 bps (bps) over Q4 2023. Occupancy is down 347 bps from the 97.5% peak in Q1 2022 and down 70 bps YOY. Effective rent grew 1.2% YOY up 60 bps QOQ. National average effective rent peaked at $1,824 per month in Q3 2022 and averaged $1,807 in Q1 2024, a difference of 93 bps. Industry analysts expect current trends to turn the corner in 2025, returning to a rising rent and occupancy environment once the flow of new supply tapers.

The first quarter of 2024 saw a notable increase in net absorption, driven by strong demand. This marked the third strongest Q1 performance in over 20 years, surpassing the pre-pandemic first-quarter average, according to a recent CBRE report. Average occupancy across the country averaged 94.1% in Q1 2024, down 11 bps (bps) over Q4 2023. Occupancy is down 347 bps from the 97.5% peak in Q1 2022 and down 70 bps YOY. Effective rent grew 1.2% YOY up 60 bps QOQ. National average effective rent peaked at $1,824 per month in Q3 2022 and averaged $1,807 in Q1 2024, a difference of 93 bps. Industry analysts expect current trends to turn the corner in 2025, returning to a rising rent and occupancy environment once the flow of new supply tapers.

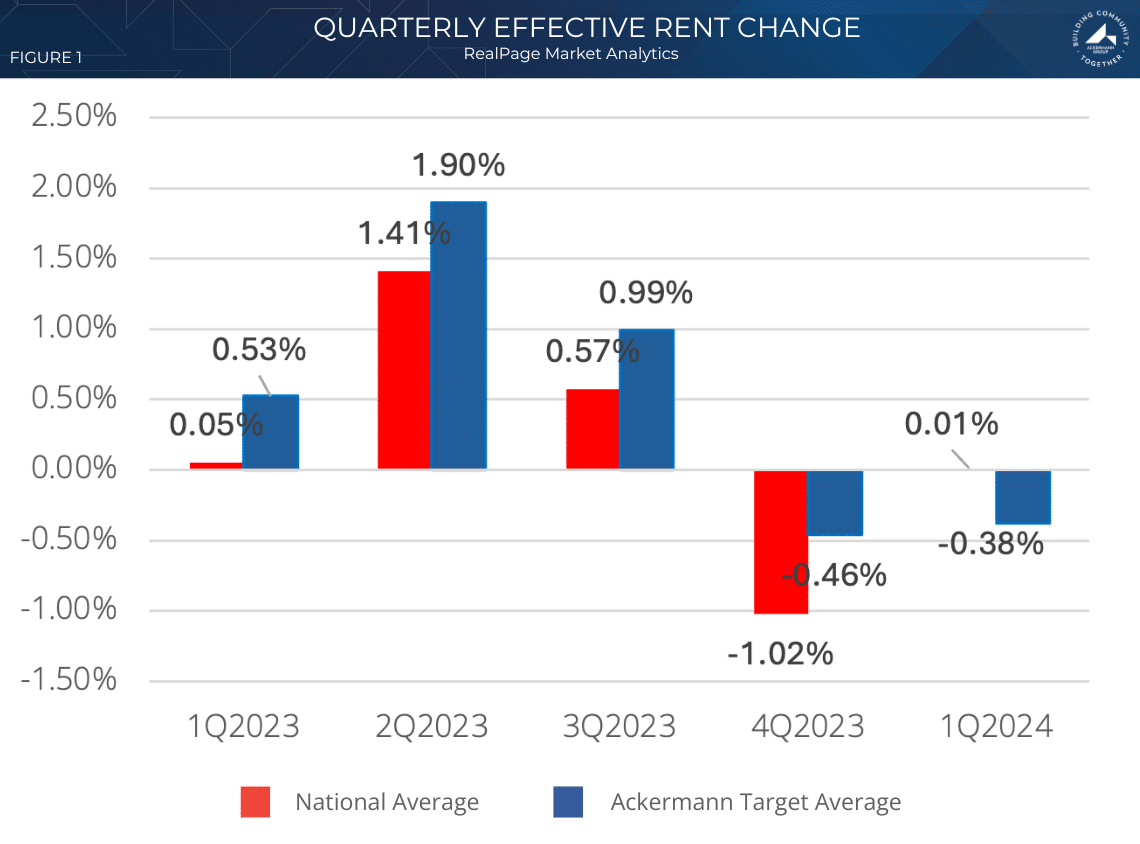

Ackermann Group’s target markets in the Midwest and Southeast demonstrate resilience amid nationwide rent growth slowdowns, maintaining relatively low supply and stable market conditions. Average effective rent grew 3.0% across our target markets in 2023. The top performers last year were Knoxville, which was up +4.8%, Cincinnati +4.6%, Indianapolis +3.9%, and Columbus at +3.3%.

The first quarter of 2024 experienced negative rent growth in 3 of our 6 target markets with Chattanooga, Greenville, and Knoxville coming in at -1.5%, -1.3%, and -0.9% respectively. Cincinnati, Columbus, and Indianapolis saw rents inch up slightly ending the period at +0.7%, +0.2%, and +0.6% respectively. Occupancy dropped 104 bps in 2023, averaging 94.7% and another 10 bps in 1Q24 averaging 94.2% in the period.

Market Value

Inflationary pressures and limited financing options contribute to market uncertainties. Despite market headwinds, there was a notable uptick in apartment sales volume after seven consecutive quarters of declines. Absorption rates struggled to keep pace with the historic levels of new supply entering the market.

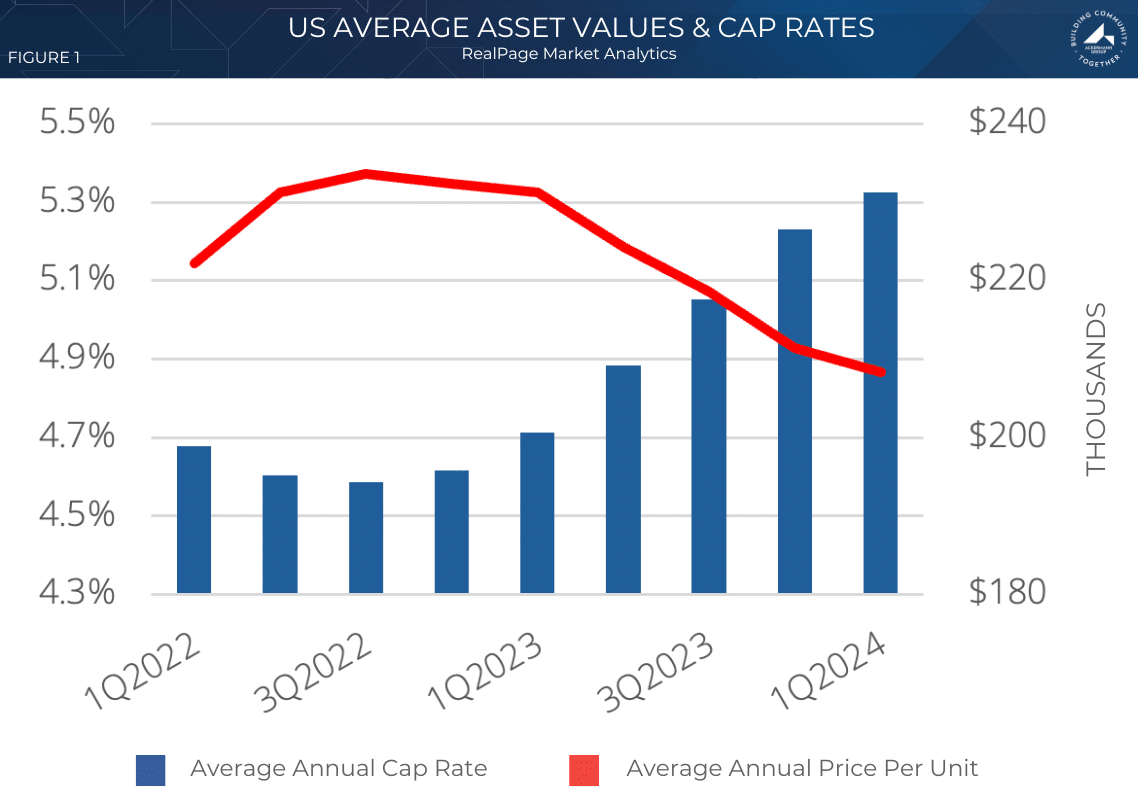

Despite a halt in interest rate hikes, a sentiment of higher-for-longer interest rates continues and is pushing cap rates up as values continue to slide. Cap rates, the metric used to gauge value based on a property’s annual net operating income, have climbed 16% (74 bps) from their low in Q3 2022, and are up 13% YOY and 7% over Q4 2023. Property values have declined by as much as -14% nationally from their peak in Q3 2022 according to Real Capital Analytics. RealPage Market Analytics is reporting Q1 2024 values are down 10% YOY and 1% QOQ.

Capital Markets

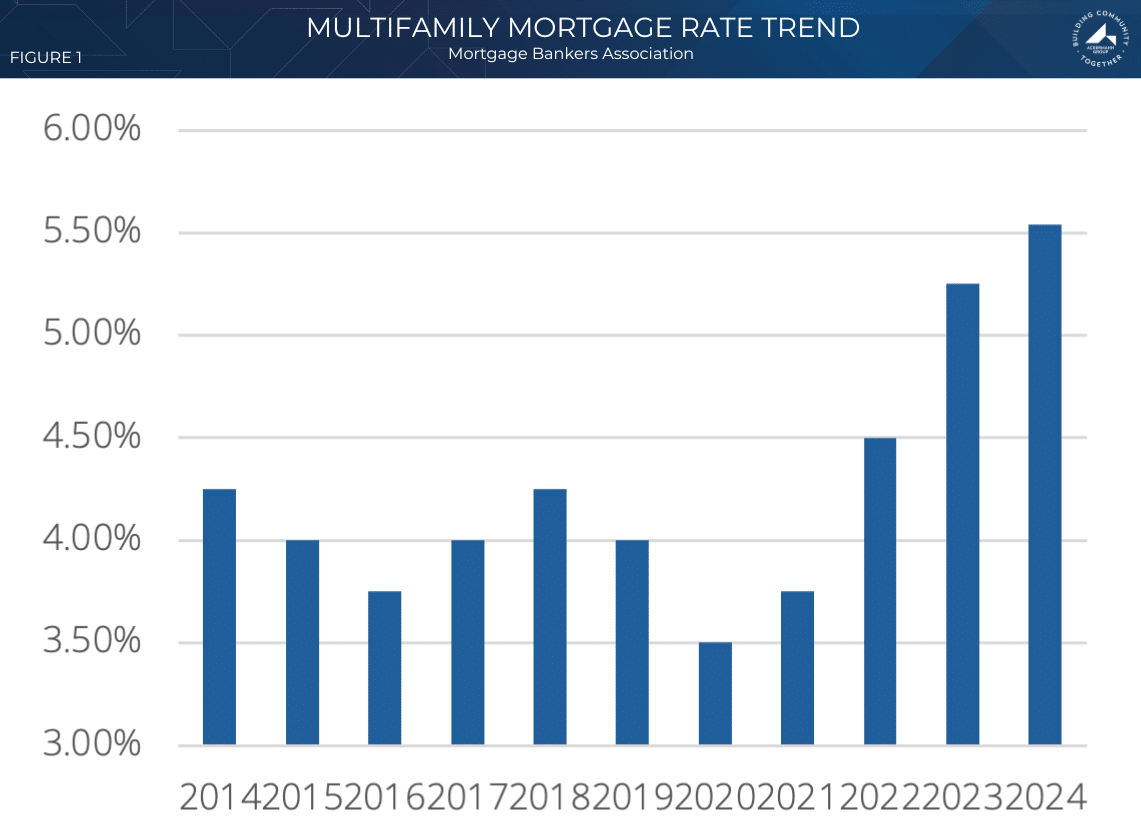

Higher interest rates pose a significant challenge for maturing debt in the coming years. The current 10-year Treasury rate of 4.5% is substantially higher than the average rate of 2.4% observed from 2014-2018 when many multifamily deals maturing in 2024-2025 were likely originated.

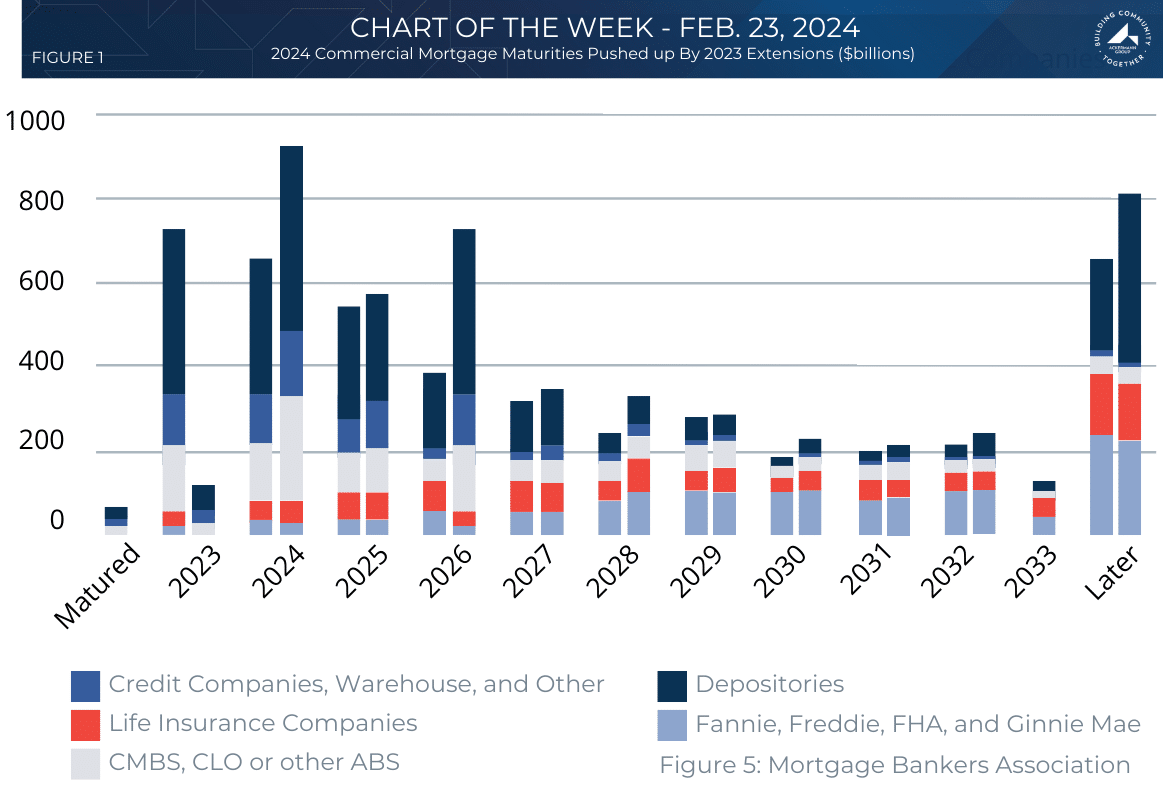

Current conditions are impacting borrowers’ ability to refinance. With limited options to extend loans, many multifamily owners will be forced to sell their properties into the highest interest rate environment in over a decade. Early in the cycle, lenders were willing to extend and modify maturing loans, but they are now increasing pressure on underperforming properties and those behind construction schedules.

A lack of transaction activity last year, coupled with built-in extension options and lender and servicer flexibility, has meant that many commercial mortgages that were set to mature in 2023 have been extended or otherwise modified and will now mature in 2024, 2025, and 2026. As a result, the amount of commercial mortgage debt maturing this year rose from $659 billion at the end of 2022 to $929 billion by the end of 2023.

The Mortgage Bankers Association reports $500 billion of multifamily debt maturing between 2024-2025, representing roughly 40% of all commercial real estate debt set to mature in the next two years.

The higher interest rate environment will challenge current loans to meet lenders’ debt service coverage tests, particularly for shorter-term, higher-leveraged loans originated in recent years. We anticipate an increase in loan maturity defaults or cash-in refinances, but it is not expected to be systemic. Properties on shorter-term debt maturing in the next two years are facing the most risk, providing an opportunity for investors with liquidity to capitalize on the resale of these assets.

New Supply

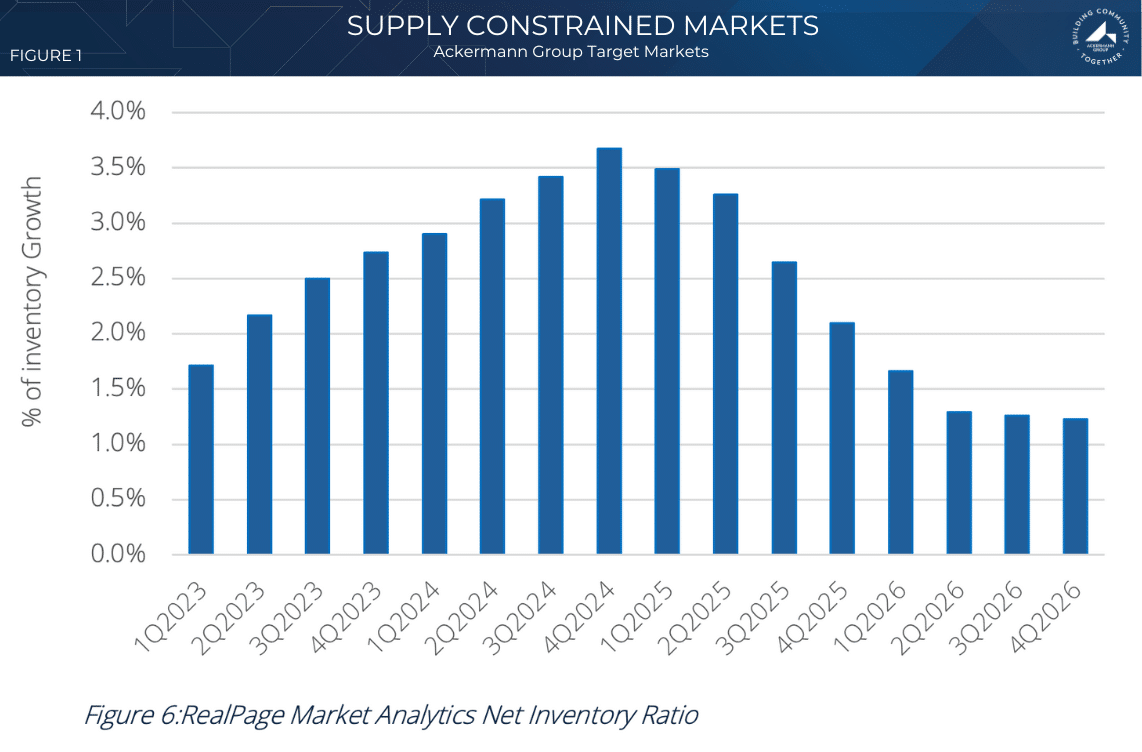

Ongoing construction labor shortages, rising material costs, economic uncertainty, and permitting and financing delays will curb the number of new permits going forward at least for the near term. There are several oversupplied metros across the country, in terms of the amount of new supply underway compared to the current inventory of multifamily units. Austin, Denver, Charlotte, Miami, Orlando, Nashville, Raleigh, Colorado Springs, and Huntsville, all have more than 10% of their respective multifamily inventories underway. In general, a market is considered in balance when it has between 2% and 4% of inventory in the delivery pipeline, and with some of these metros expecting below-average job growth this year, many are expected to remain oversupplied over the next 12 to 18 months.

2024 Ackermann Group Forecast

The economy in 2024 is expected to experience slower growth compared to 2023. Employers are forecasted to add approximately 1.5 million net new jobs, about half the total from the previous year. The moderation in job growth will likely translate into weaker renter demand for multifamily housing.

The multifamily market in 2024 is expected to face further challenges due to a significant influx of new supply outpacing demand. However, this dynamic presents opportunities for investors to capitalize on secondary markets in the Midwest and Southeast regions.

Key trends include:

- Over 700,000 rental units projected to be delivered in 2024, representing an elevated supply pipeline.

- Net absorption slows and is unable to keep pace with the influx of new units.

- The supply-demand imbalance continues to pressure rent growth and occupancy downward.

- Nationally, vacancy rates are forecasted to rise to around 5.7% in 2024, higher than the long-term average of 5.3%.

- Rent growth is projected to slow to 2.5% in 2024.

While primary markets grapple with oversupply, secondary markets offer attractive investment prospects. The supply and demand balance in supply-constrained markets like Kansas City, Cincinnati, and St. Louis supports stronger occupancy rates and rent growth potential. Favorable demographics, with population and job growth in cities like Indianapolis, Columbus, Raleigh, and Nashville, drive multifamily demand. Secondary markets offer lower entry costs and higher cap rates compared to primary markets, leading to better yield opportunities.

As the supply pipeline moderates from 2026 onwards, with projected completions falling below 200,000 units annually, the supply-demand balance is expected to improve. Markets that have been resistant to new development or overlooked by developers should maintain occupancies and record modest rent increases during this period. Investment activity is projected to gain momentum, fueled by newly constructed properties stabilizing or selling during lease-up phases, as well as some distressed asset sales.

Anticipated declines in interest rates and the accelerating property sales pace should support greater activity in debt and equity markets for multifamily investments from 2024 onwards. However, obtaining capital for new development will remain challenging, with financing more readily available for acquisitions.

Despite the near-term headwinds posed by oversupply, the multifamily sector’s long-term outlook remains positive, underpinned by an overall housing shortage, affordability challenges for homeownership, and rising rental demand from younger demographics.