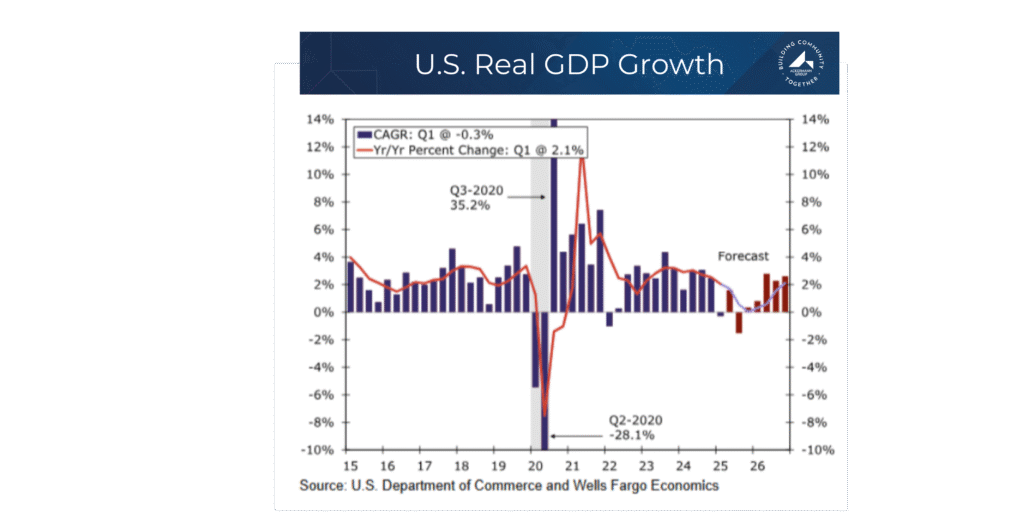

U.S. Economic Overview

The U.S. economy contracted in the first quarter of 2025 at a 0.3% annualized rate. This decline is not likely the start of a sustained downturn, but rather a reflection of a sudden change in trade policy that led to the largest drag on net exports in over half a century. This environment may bring higher inflation, with forecasts predicting a 3.3% increase in prices on a year over year basis by the end of 2025. In response to weakening growth and potentially rising unemployment rate, the Federal Reserve is anticipated to restart its easing cycle. Wells Fargo forecasts 125 bps of rate cuts by the end of 2025, lowering the federal funds target rate range to 3.00%-3.25%.

National Apartment Market

Effective rents nationwide increased by 0.3% in the first quarter of 2025, bringing the annual rent growth to 0.8%. This annual pace is below the record increases seen in late 2021 and early 2022, and below the five-year average of 3.6% prior to the pandemic. While still muted by historical standards, rent growth gained momentum in Q1 2025.

The national apartment occupancy rate in Q1 2025 stood at 95.0%. This represented an increase of 0.2 percentage points quarter-over-quarter and was up 0.9 points year-over-year. While slightly below the nation’s pre-pandemic five-year average of 95.2%, it falls within the five-year historical range. Occupancy continued to tick up due to strong demand. Occupancy rates across different product classes (Class A, B, and C) were tightly clustered in Q1 2025, indicating healthy demand even for units most vulnerable to competition. reached 576,720 units, slightly below the total for calendar year 2024. This marks a clear indication that the U.S. has moved past the peak of its current apartment supply cycle. With the construction pipeline continuing to thin, supply pressures are expected to ease further in the coming quarters.

Apartment demand was once again extremely strong in the first quarter of 2025 with the U.S. absorbing 138,302 units. This marked the highest Q1 reading ever recorded in RealPage’s data set. Annual absorption jumped to 707,871 units in the year ending Q1 2025, well above concurrent supply and nearly meeting the all-time high recorded from early 2022.

Ackermann Target Markets

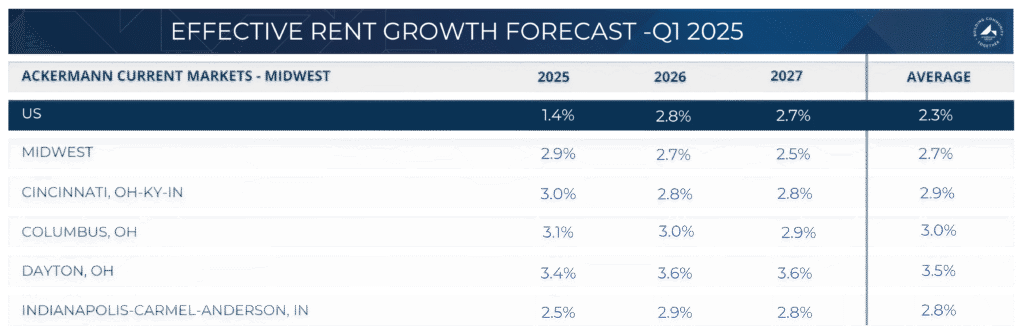

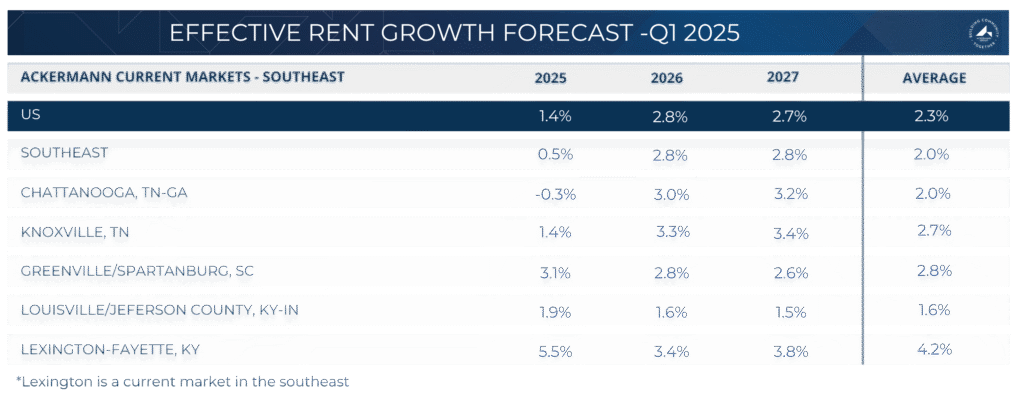

As noted above, rent growth nationally is finally accelerating as new supply is absorbed and the construction pipeline clears. However, in the Ackermann Groups current and target markets – the limited supply growth has provided more stable performance and is forecasted to outperform the US in the next 2+ years. The data below, provided by RealPage Market Analytics shows effective rent growth forecasts for Ackermann Groups markets compared to the greater US, Midwest and Southeast regions.

From a rent growth perspective, the Ackermann Groups Midwest markets are forecasted to outperform both the United States rental market as well as the rest of the Midwest region.

In the Southeast, the Ackermann Groups target markets are forecasted to perform at least in line with the Southeast or better than the US, apart from Louisville, KY and Chattanooga, TN. It should be noted that Lexington, Kentucky is forecasted to have the highest rent growth in the country for 2025 (out of the top 150 US markets).

Capital Markets

In Q1 2025, lending activity saw shifts, with banks increasing their share of loan originations compared to a year prior, with the CMBS market emerging as the second most active lending group.

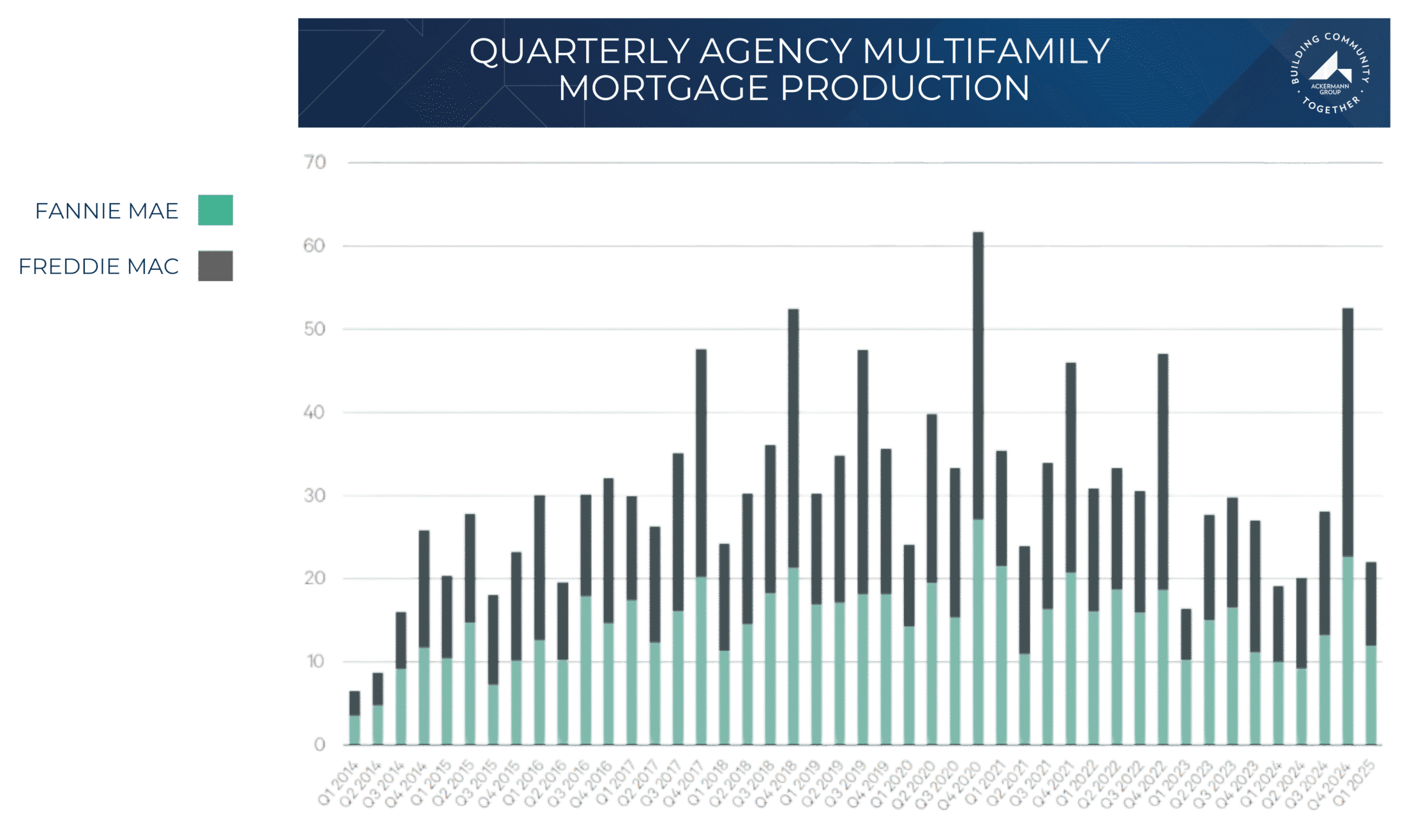

Multifamily mortgage debt outstanding continued to grow faster than the overall commercial real estate market in Q4 2024, significantly driven by Agency lending activity. Agency lender multifamily origination volume experienced a sharp quarterly decrease but a year-over-year increase in Q1 2025. Agency volume in Q1 2025 decreased by 58% quarter-over-quarter but increased by 15% year-over-year, totaling $22 billion.

The below shows agency production since 2014. At Ackermann Group, we pursue a conservative acquisition strategy using fixed-rate, non-recourse loans exclusively from Freddie Mac. This approach provides long-term stability and access to their favorable supplemental loan program, offering liquidity opportunities early in the investment cycle.

Mortgage delinquency rates increased across several lender types in Q4 2024 and early Q1 2025, and the substantial volume of loans maturing in 2025 poses a challenge for borrowers seeking refinancing, potentially leading to further delinquency increases.

Investment Sales

The first quarter of 2025 saw increased investment activity in the commercial real estate market, with multifamily leading the way.

Multifamily remained the leading property sector for investment volume in Q1 2025, accounting for $28.8 billion, a 33% increase compared to Q1 2024. This represented 32.6% of the total investment volume across all property types. Single-asset multifamily investment volume specifically also saw a strong increase, reaching $24.5 billion in Q1 2025, up 36.3% year-over-year.

Looking at buyer types, private investors accounted for the largest share of Q1 2025 investment volume at 58% ($51 billion), an increase of 19% from a year ago. Institutional investment volume more than doubled year-over-year to $20 billion, making up 22% of the total. REITs/public companies were the only buyer type to see a year-over-year decline in volume. In Q1 2025, private and institutional investors were net buyers, while REITs and cross-border investors were net sellers.

Summary and Forecast Update

The U.S. economy experienced a technical contraction in Q1 2025, primarily due to a large drag from net exports. In response to expected weakening growth and potentially rising unemployment, the Federal Reserve is anticipated to begin lowering interest rates later in the year, with a total of 125 basis points of cuts forecast by year end. The national apartment market saw modest rent growth in Q1 2025 but recorded the highest Q1 demand ever, leading to an increase in the national occupancy rate to 95.0%. While a significant volume of new supply was delivered, the market has passed its peak apartment supply wave. Multifamily investment volume saw a notable increase, leading all property sectors in Q1 2025. This trend reflects investors comfort with the multifamily asset class despite overall market uncertainty.

Overall, the fundamentals of the multifamily asset class continue to be stable despite the uncertainty created by the tariff announcements in early April. Positive national rent growth, an occupancy rate above 95%, combined with below average supply growth moving forward signal strong rent growth, especially in 2026 and 2027. In The Ackermann Groups current and target markets, these trends are more pronounced as demand has been stable, but the wave of new supply has been less severe – meaning the outperformance trend is expected to continue into the foreseeable future.