Chris Kohnen, Chief Investment Officer

In this issue, we provide a market update through Q3 2023, and Ackermann Group’s outlook for year-end 2023 and 2024. We highlight statistics on the new apartment supply and how it ties to performance. We will explain how demand drivers are in our favor today and long-term. Lastly, we underscore our current investment strategy and why high interest rates, low rent growth, and occupancy, present a window of opportunity over the next 3 years.

Rent and Occupancy Performance

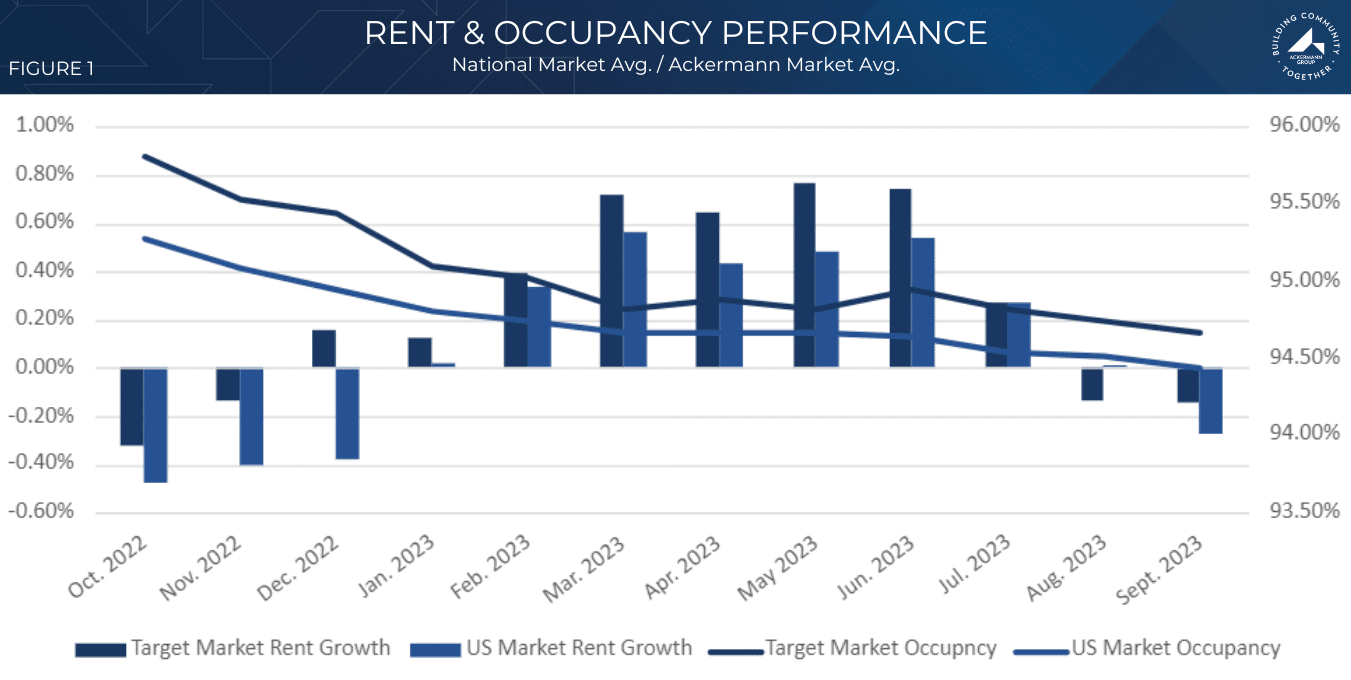

Rent growth across the country experienced a market correction in the later part of 2022 (Figure 1) from the unprecedented gains realized in 2021 and the first half of 2022. The first half of 2023 market performance (leasing velocity, rent growth, occupancy) has settled into more typical patterns aligned with Pre-pandemic averages.

Notably, national average effective rent year-to-date (“YTD”) through September 2023 has increased by 2.36%. Albeit, with a -0.37% drop in occupancy, averaging 94.6% YTD. We expect a slowdown in leasing activity through Q4 2023, which aligns with typical seasonal leasing trends. National effective rent is expected to grow 1.4% in Q4 to end the year +3.8% year-over-year (YoY). Occupancy will end the year just over 94% down 72 basis points (“bps”) in the year.

In Ackermann Group’s target markets, including Cincinnati, Indianapolis, Columbus OH, Greenville SC, Chattanooga, and Knoxville, average effective rent grew 3.4% YTD through September. During this same period, the average occupancy rate held steady at 94.9%. It is worth noting that effective rent trends in August and September have shown a slight decline in these markets. As a result, we anticipate the annual average effective rent to finish 2023 +3.3% for the year. Concurrently, the occupancy rate is expected to decline 12 bps in Q4 ending the year at 94.5% down 56 bps in the year.

As we look ahead to 2024, our projections indicate that both the United States and our specific target markets will experience consistent occupancy rates, averaging in the 95% range. Additionally, we anticipate effective rent growth to exceed 3.0%. To provide context, it’s noteworthy to compare these projections with historical data. Over the period of 2010-2019, our target markets maintained an annual average rent growth of 3.6% and sustained an average occupancy rate of 94.8%. These numbers underscore the return to more typical performance metrics in our target markets.

Inventory & New Supply

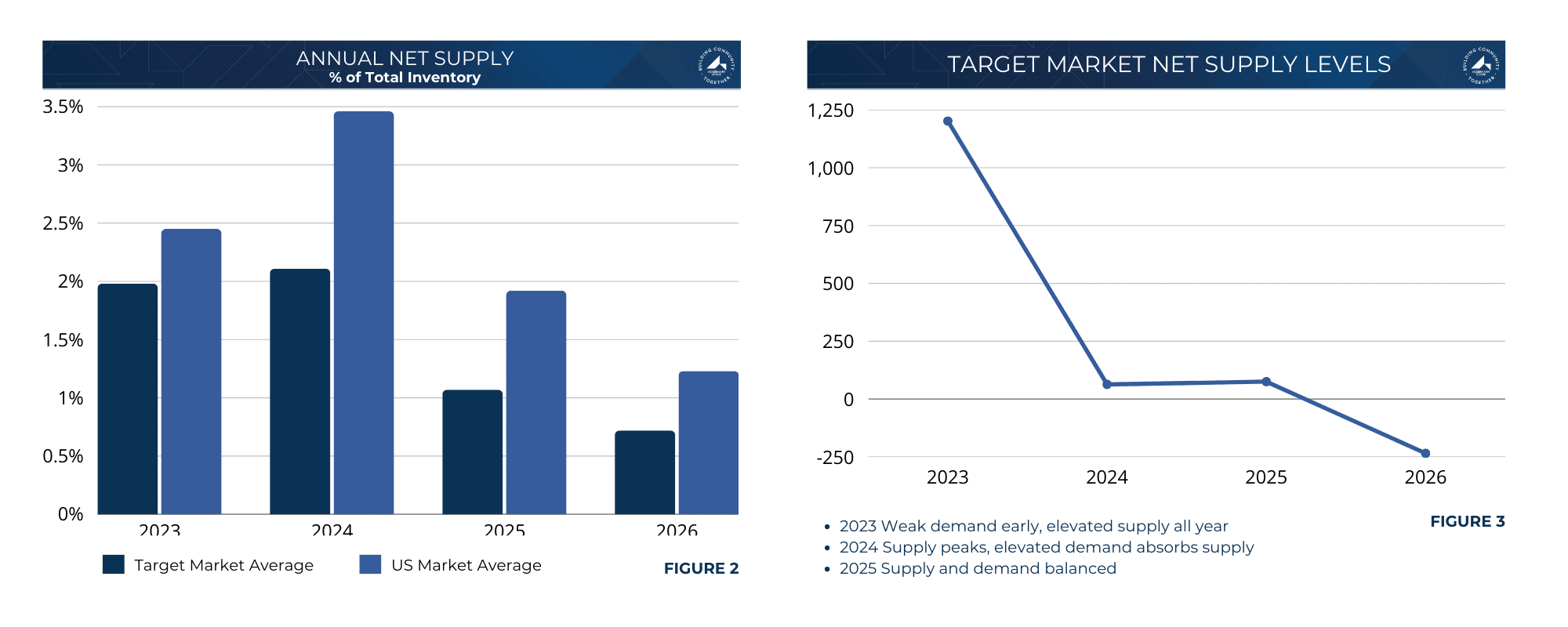

The spur of new construction activity coming out of the pandemic stalled as interest rates reached unmanageable levels. However, construction activity over the last 3-6 months began entering the market in the second half of 2022 resulting in softer occupancy and lower rent growth. As depicted in Figure 2 and Figure 3, new supply–the industry term for new apartments units delivered to the market– will peak in 2024 before returning to a more balanced allotment at or below 1.00%. RealPage is reporting that multifamily starts will drop 30% YoY in 2023, with the drop-off accelerating in the second half of the year. Completions are on track to peak in the second half of 2023 through 2024.

The dynamics of supply and demand vary. A recent report by GlobeSt.com highlighted the fact that the supply situation is not uniform across all markets, and it also varies depending on the specific type of housing. According to this report, the new supply nationwide is predominantly situated in primary markets, downtown districts, and affluent suburban areas. In contrast, secondary markets and middle-income suburban neighborhoods have comparatively lower levels of new supply. This diversity in supply and demand patterns underscores the importance of a nuanced and market-specific approach in our investment strategy.

In broad terms, inventory growth falling within the range of 1% to 3% is typically manageable and poses a low risk of negative impact to occupancy and rent growth. The effect of new supply depends on various other factors, notably the rate of population and employment growth. These two factors play a significant role in household formation and, in turn, influence the potential repercussions of elevated inventory levels.

Market Demand

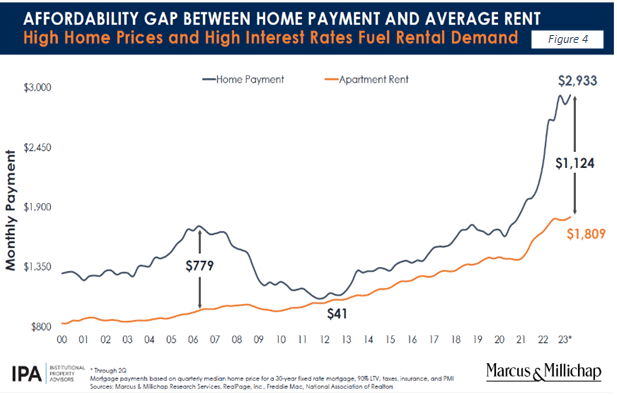

Demand is typically not a concern in the multifamily sector and recent forecasts indicate this trend will continue. The U.S. apartment market absorbed 90,827 units in Q3, according to RealPage Market Analytics. That is the largest quarterly total in nearly two years. In Figure 4, Marcus and Millichap reports the cost of home ownership is 62%/$1,124 more per month than renting. The Wall Street Journal recently reported that the last time this measure looked out of the ordinary was before the 2008 housing crash and the premium was only 33%. No question climbing mortgage rates is a major contributor to apartment demand today, but another factor we don’t give enough credit is the economy. Apartment demand was strongest in 2021 when interest rates were low, and more homes were selling, then demand vanished in 2022 when rates jumped, and sales slowed. Real Page makes the argument that slowing inflation and a persistent job market are boosting consumer confidence and spurring household formation among young adults most likely to rent apartments. It is generational demand that is choosing lifestyle over the American Dream.

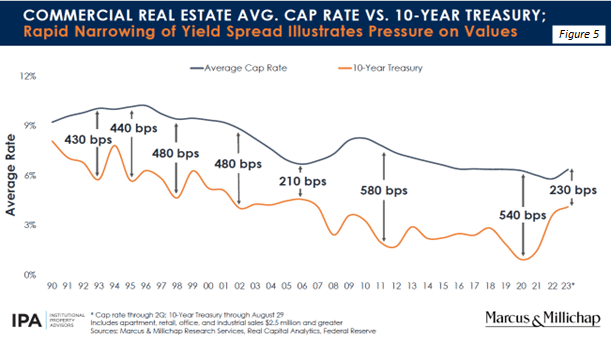

As interest rates ascended, they grabbed the media headlines and the pace of transactional activity decelerated. During the first half of 2023, transactions primarily involved capital marked by impatience, such as 1031 exchanges and other related strategies, accepting low yields, resulting in artificially low capitalization rates (“cap rates”) as seen in Figure 5, narrowing the spread between cap rates and the 10-year Treasury, the primary borrowing. Since Q1 2022, cap rates have climbed 155 basis points, surpassing the pre-pandemic average by 70 bps. The Federal Reserve has been hinting that rate cuts will not happen this year as previously indicated, now implying late 2024 or possibly 2025.

What has not garnered as much attention in the media is the unprecedented volume of low-rate loans that originated in the last 5-10 years maturing amidst the most elevated interest rate environment in over two decades. The industry is bracing for a significant market shift as approximately $1 trillion of multifamily debt maturing over the next 4 years according to the Mortgage Bankers Association. Borrowers confronted with maturing debt are encountering the prospect of selling or refinancing, the latter will likely necessitate a cash injection to overcome today’s interest rates, eroding returns.

The challenges faced by apartment owners with impending loan maturities present a window of opportunity for well-capitalized investors. Record loan maturities and prevailing interest rates will generate an excess of investment opportunities, marking a shift in the marketplace favoring buyers. We anticipate a sustained expansion of cap rates in 2024 as transaction volumes rise, leading to fundamental price discovery. Reports indicate a significant drop in construction permits, signaling a decrease in new supply during the second half of 2024. Rent growth and occupancy will remain sluggish until the supply/demand ratio shifts, and the market returns to sustainable positive performance in 2025. Ackermann Group holds a very optimistic view of the multifamily sector in the long term. However, today we perceive a unique opportunity to capture value in the market, offering returns greater than the average over the next 10 years.

Our Strategy

Our strategy incorporates responsible investing practices. Firstly, we employ fixed-rate, non-recourse debt to mitigate risk and secure reliable cash flows. Secondly, we implement the use of supplemental loans to seize opportunistic liquidity events, thereby returning capital to investors earlier and reducing the risk associated with our investments. Lastly, we steadfastly uphold the significance of conservative underwriting assumptions and remain committed to meeting our minimum return thresholds.

Ackermann Group has built a reputation for finding good deals in all stages of the investment cycle. With 85 years of experience, Ackermann Group takes a patient approach to investing, striking when opportunity and market align.